The terminal interest rate refers to the long-term target interest rate that central banks aim to achieve at the end of a monetary policy cycle. It represents the equilibrium interest rate where monetary policy neither slows down nor speeds up the economy. Central banks often set this rate as a benchmark for other interest rates in the economy, such as mortgage rates and corporate bonds. The terminal rate is influenced by economic forecasts and is used to guide monetary policy decisions, balancing inflation control with economic growth.

We were asked last week about the Terminal Interest Rate.

There is not much economics behind the terminal rate. It is a convenient market vernacular only, that is intended to reflect futures pricing of interest rates in the months ahead. The terminal rate could then be the expected high or low point in the current business cycle. It is often confused by our media and some traders as the neutral rate of interest referred to by central banks.

The surge of inflation to a level above what the RBA was expecting in the September quarter (The RBA was expecting a trimmed mean of 2.6% and the outcome was 3%) has generated a lot of debate about what is the NAIRU (Non Accelerating rate of Unemployment) and what is the neutral interest rate. The NAIRU is regarded as the level of unemployment consistent with the point at which the economy is at ‘full employment’. When unemployment falls below NAIRU, wages growth increases and this results in higher inflation, just as, when unemployment is above NAIRU, wages growth moderates and there is less pressure on inflation. Over the past few years where unemployment has fallen sharply without increasing inflation there were some that thought the NAIRU was below the RBA’s 2023 estimate of 4.75%. Now with inflation increasing and unemployment rising this is being re-assessed. The following article in the AFR on Sunday touches on this. RBA interest rates: how economists and the market got it so wrong on inflation

The neutral interest rate is the interest rate judged – at the time – that is not stimulating or restricting economic activity. The RBA would judge the neutral rate to be where we have full employment or the NAIRU with inflation sustainably within the 2-3% range. In any one economic cycle the neutral rate will be different as there are many factors at work with different economic lags such as:

- State & Federal fiscal policies.

- Wages growth and regulations.

- Business investment and its impact on labour productivity.

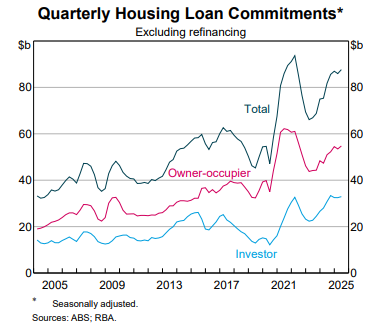

In an Australian context where borrowing activity is residential focused we accept that the neutral rate is the RBA official cash rate consistent with a stable private sector credit outcome. When monetary policy is restrictive private borrowing for residential property would be falling and when monetary policy is stimulatory, relative to the factors above, such as government fiscal policies, we expect private borrowing for residential property to be strong. In the last week of October the RBA chart pack release (The Australian Economy and Financial Markets) showed that house related loan growth was strong and this prompted APRA to warn the banks to employ macroprudential risk tools to manage lending risks. Australian property market: APRA warns banks over investor lending amid rising house prices

This strong loan growth is a signal that the current monetary policy settings are stimulative and the RBA official interest rate is the below the neutral rate. We don’t see a need for the banks to making any changes to their macroprudential settings given the fact that 30-90 day loan arrears are at record lows.