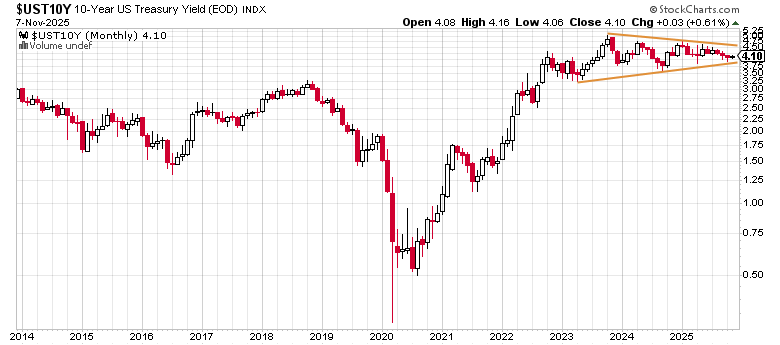

The US 10 year yield chart shows a symmetrical triangle has formed on the monthly chart. This is significant because:

- the triangle has more than three touch points on the support trend line making it valid;

- the triangle has 2 clear resistance points, making it valid;

- it is a monthly chart so the noise of a daily chart is deleted;

- the triangle suggests a technical 75% probability of an upward breakout with a technical targeted move of 1.36% from the breakout point. If the breakout point is 4.5 percent in the upside target is 5.86% (1);

- the triangle suggests a technical 25% probability of a downside breakout from 3.8% implying a target of 2.44% (2)

We then have two outcomes to be considered. What would need to occur to get either one and perhaps even both eventually?

If this breakout is due to occur in either November or December, as the triangle suggests, then the most obvious catalyst is a Supreme Court ruling against Trumps general country tariffs. This would mean the repayment of US $50 billion of tariffs and it would undermine the perspective budget outcome. Treasury would then have to increase their planned issuance into the treasury bill market. The treasury bill market is already straining under the current supply and the government is looking at ways to boost demand. These include:

The Federal Reserve being a buyer of last resort. Since the QT programme began U.S. banks have been taking the shortfall from the auctions but are now near their limits. The signal from the Federal Reserve last week that they would cease QT is an early signal that the Federal Reserve may buy at the debt auctions;

The removal of the capital risk applied to U.S. Treasury holdings at a bank level is also an important step. It would also be consistent with the Basel rules;

The US needs to pass a budget to lift the shutdown that actually cuts fiscal expenditure and more importantly shows a path to a balanced budget.

A break down in the 10 year yield to such an extent in November or December would require an external shock such as a war or pandemic that shuts down the economy. This seems unlikely and it’s impossible to forecast.

If the trigger is a stock market crash, then we will also see a huge blowout in credit margins. Much has been made of the First Brands, Tricolor and Primalend auto lending sector issues. In any economic cycle finance in the auto sector is often the first domino or cockroach, as autos are a discretionary good. The real problem will come when the US non-investment grade and investment grade corporate deals rated triple B minus are rolled from the fixed rate coupons taken in 2020-2021 and early 2022 before inflation emerged and interest rates surged. The US investment grade debt market is $9 trillion and of that 5 trillion is triple B minus rated. A lot of this debt is sitting in passive index funds and ETF’s. The passive fund or ETF exposures will exaggerate the margin expansions because if a triple B minus rated issuer is downgraded either because of the jump in its interest rate costs with the margin expansion or because of an economic contraction that damages its earnings, then it will fall out of the index to which the passive ETF is bound to follow. The inherent nature of a passive fund is that tracks an index. There is no credit analysis done on the issuers and no analysis of the terms and conditions of each bond. The index fund cannot anticipate a bond being added or subtracted from the index like an active manager can with solid analysis.

The other advantage that an active manager will have over a passive manager will be that an active manager can look at the specific bond terms. Over the past 10 years we have seen many times the market and mostly retail investors, reacting to an issuer that is having a bad earnings period and selling its senior secured debt at big discounts. A good active manager finds the best returns from lending to firms with bad media publicity and poor short term earnings but with a level of assets that make a senior secured lend a mispriced risk by the market.