Arculus Funds Management is an Australian boutique asset manager with specialist skills in debt management. Combined, and manages over $800m in a range of fixed interest portfolios. Capital preservation underpins our investment strategy.

We have extensive experience in investing, from fixed income, public and private equity, derivatives, and hybrids. Our team has amassed more than a century’s worth of knowledge through several significant market cycles, crashes and rallies.

We manage two retail public unit funds for DDH Graham Limited:

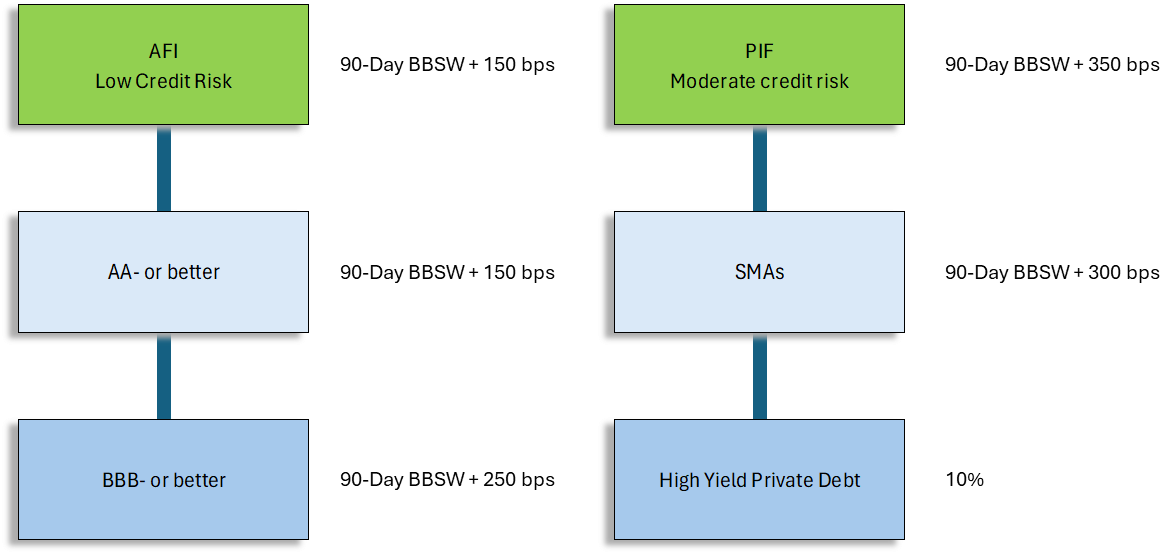

- The Arculus Preferred Income Fund, formerly the DDH Preferred Income Fund (PIF).

- The Arculus Fixed Income Fund, formerly the GCI Australian Capital Stable Fund (AFI).

In addition to these public unit funds Arculus Funds Management has a number of private mandates with bespoke investment universes, risk requirements and target returns.

Central to our belief in risk minimisation is the principle that the role of Investment Manager be separate from the other key roles:

- Responsible Entity, Trustee or investor where mandate compliance is determined and monitored;

- Administrator where portfolios are valued independently and performance is calculated;

- Custody;

In addition to these public unit funds the Arculus Funds Management team under the GCI Australia AFSL have a number of private mandates that have a similar investment universe and are managed with a focus on firstly capital preservation and secondly income generation.

Our risk management process has many levels that include:

- Investment risks.

- Regulatory risks.

- ESG risks.

- Conflicts of interest.

Risk management is central to our focus on capital preservation and providing consistent income.