Firstly, I must point out that we are an absolute return fund manager. A credit fund sources returns from the coupon running yield and the move in credit margins. A fixed income fund sources its returns primarily from capital gains when the yield on the bonds falls. An Absolute Return Fund is ambivalent between gaining performance from the coupon running yield or capital gains on a fixed rate bond. It has the flexibility to shift from floating to fixed rate bonds if the benchmark yield curve is expected to flatten.

Even though the portfolio has a very short, fixed duration – so not exposed to a rise in the benchmark yield curve and is a beneficiary of a rise in the 90-day BBSW rate, but we have two problems. These are:

- Credit margins on senior bank bonds are very tight at +70bps (5-year) and Tier 2 margins are absolutely tight at @+132bps (5-year). This risk of a margin expansion from these levels is high. A margin expansion on a floating rate bond will result in a fall in the bonds capital value.

- There is no macroeconomic basis for buying fixed duration yet.

Within these two problems we need to minimise credit spread risk and minimise fixed duration risk. It is a time to be patient, accept a lower portfolio yield that is approaching the cash rate and be prepared to act on one of two outcomes. These are:

- Economic risk rise, either for domestic, global or geopolitical reasons and this results in credit margins expanding significantly.

- Fixed bond yields spike higher and trigger an economic contraction. We need to be ready to pounce on a spike in the 10-year bond yield. Since the collapse in bond yields in the pandemic we have minimised the duration exposure as the risks to the bond market at a geopolitical level and with inflation rising did not warrant exposure.

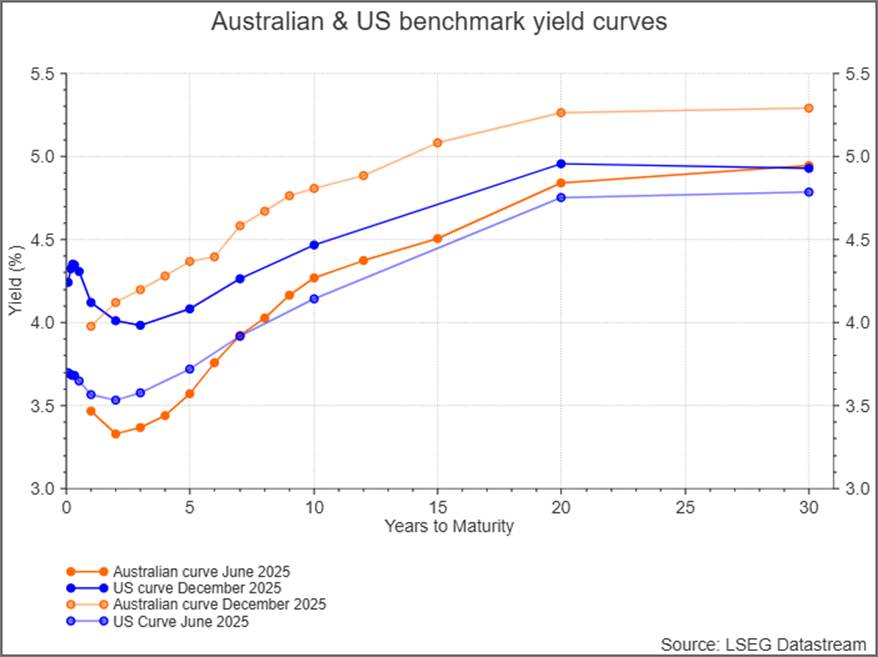

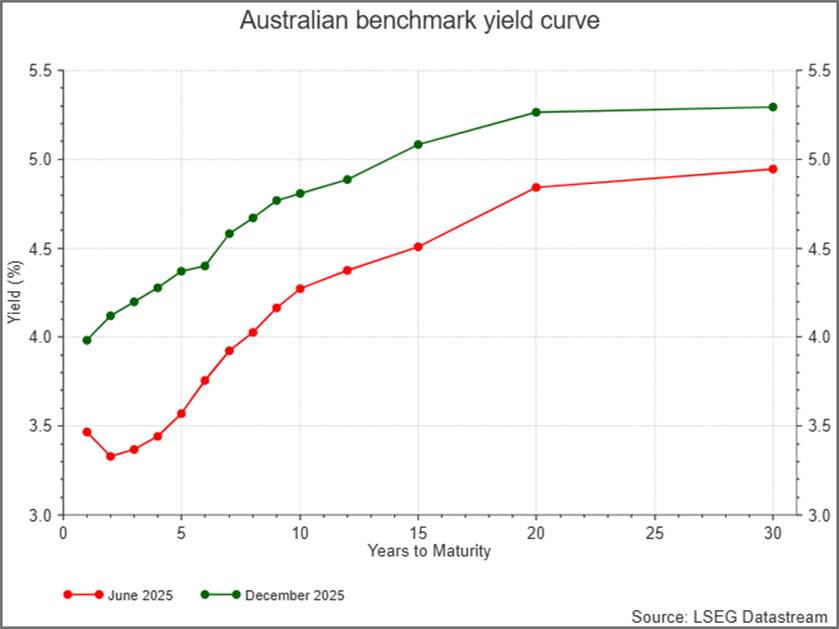

Since June 30 this year we have seen the Australian 10-year bond yield move from a 15bp discount to the US 10-year yield to the current 60bp premium.

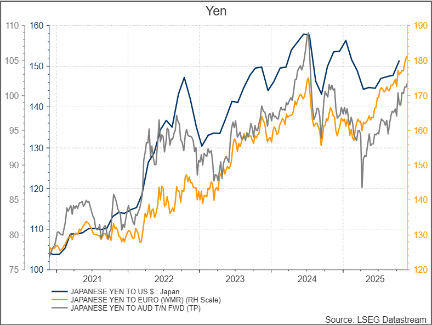

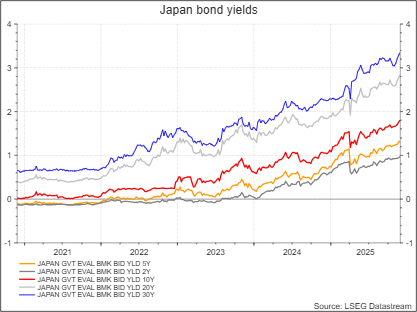

This shift in the Australian curve can be explained by the re-emergence of inflation pushing up the short end of the curve and the rapid unwinding of the Euro-Yen carry trade at the long end.

The Yen has weakened significantly over the past few months, and Japanese bond yields have risen.

We have not reacted to this increase in the Australian 10-year yield premium over the US 10-year for two reasons:

- At the short end of the Australian curve the 1-year bond yield has surged 50bps since the September CPI reading shocked the market. The incompetence of the Australian Government’s economic management was expected and is a given assumption in the analysis. We have for twelve months been forecasting that the disinflation from the transitory impact of the pandemic lockdowns on global supply chains would be superseded by ‘cost -push’ inflation.

- The US 10-year yield looks poised to break upwards over the next few months. The technical target from the symmetrical triangle on the chart below is a 1.65% yield surge from the breakout through the downward sloping resistance line. At this stage that would mean a move through 4.50% may trigger a yield target over 6%. Conversely if the trend support line breaks then yields would collapse by 1.65% from the 3.85% down to 2.20%. It is hard to see – at this stage – an economic argument for either of these outcomes.

Lost amidst the misinformation propagated by our banks, fixed income managers are still forecasting interest rate cuts next year and then marketed for free by our hapless media is the fact that the RBA does not control, with monetary policy, anything but the overnight cash rate. It has influence over the short end of the curve (0-3 years) and very little impact on the long end of the curve (5 to 10-year). The long end of the curve has risen because of the unwinding of the Yen carry trade – nothing to do with RBA policy. The other thing to remember is that Australia is vulnerable to changes in demand for its bonds from offshore investors because of its high level of household and government debt.

The decision to jump from floating rate bonds – even very short-dated ones – to 10-year AAA Commonwealth Treasuries is not easy. Preparation is the first step. The payoff for the risk is a 9% capital gain for every 1% fall in the 10-year yield from the entry point. The ability to change strategy and make this decision is the reason investors choose an absolute return fund over a credit or benchmark aware fund.